They say the key to success is having the right mindset.

Have you ever wondered how successful people differ from the rest of the world? There are a lot of factors that hinder a person to achieve financial freedom such as financial literacy and capability, consumer protection and regulation, women and the rural poor, etc. In contrast, based on most people's experiences, they believe how they think about wealth, success, and money is crucial. Some would even add that it's not about connections, luck, or birth.

A rich mindset pertains to being self-sufficient and building paths of financial opportunities. It allows you to surround yourself with people who help cultivate your perspective and become a second-hand learner from their experiences.

A positive frame of mind, wary risk management, a continuous learner, and concentration on acting in good conscience are traits embodied by people with rich mindsets. This takes the edge off becoming destitute after calamity strikes and helps obtain financial goals in the long run.

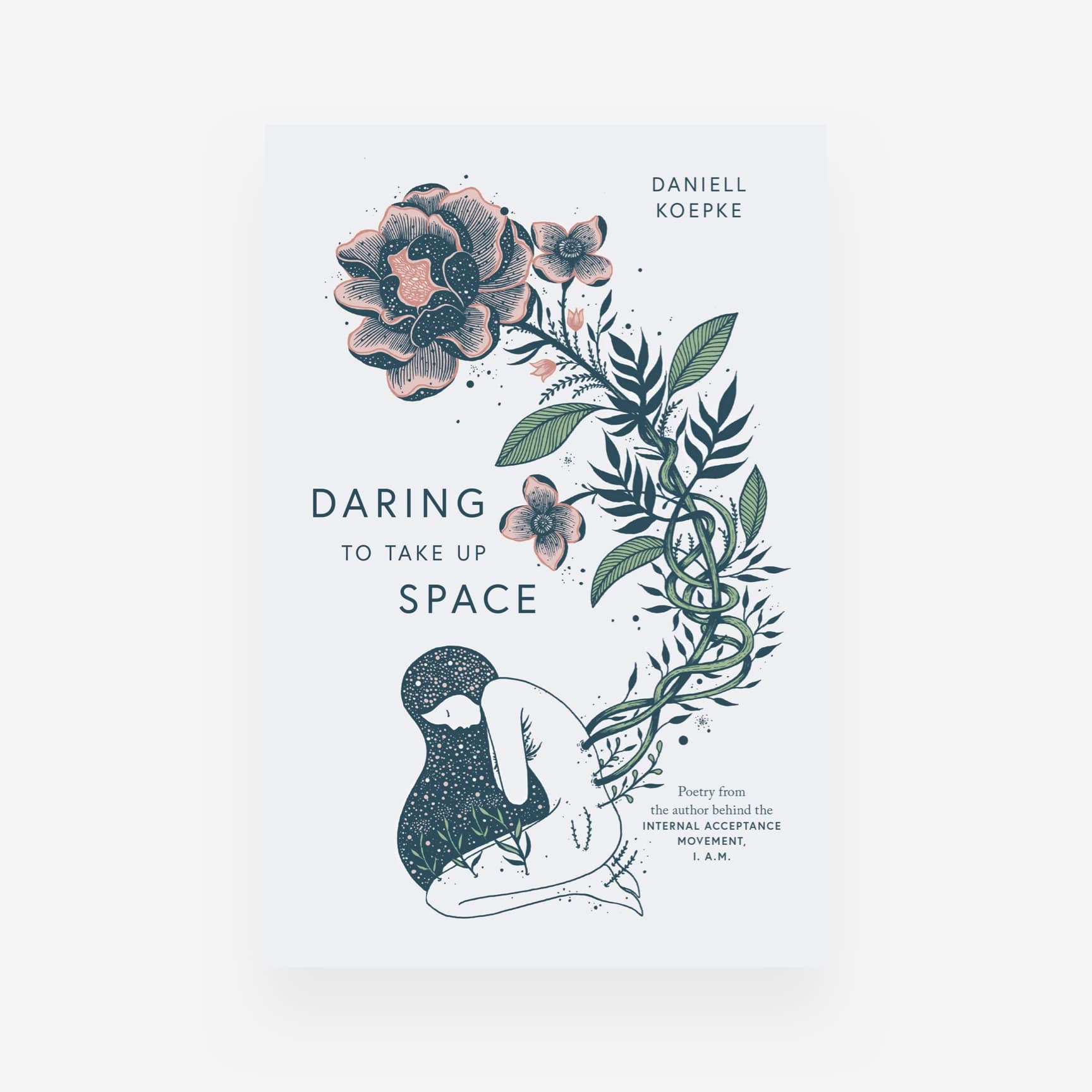

Photo from Thought Catalog on unsplash.com

Let's explore these surprising differences between how the rich and poor mindsets think:

1. They create their life.

If your goal is to build your wealth, it's essential that you are the captain of your ship; that you ensure to create the life you envision to have, most especially in the financial aspect. Rather than taking the power of responsibility with their life, most people tend to pity themselves. This leads to an ideology that life owes them the great things in the universe. Unfortunately, as much as we want to believe that, the world won't stop revolving for us. As painful as it seems, our only option is to move forward and learn from these events.

2. They are bigger than their problems.

The path towards getting rich is not all rainbows and unicorns. It's a difficult and steep journey consisting of self-doubts, twists, breakdowns, and obstacles. In simple terms, success is not a linear journey but a messy one. There's no shortcut nor an instructional guide to achieving this path effortlessly. And that's why a lot of people quit even before starting. They don't want the problems to add a burden to their current situation.

Frankly speaking, the key to success is not to elude from these problems. These exist to encourage yourself to grow and push yourself from your comfort zone. Inevitably, problems always appear, but what's important is how you deal with them to your advantage.

3. They focus on opportunities.

Whether it's the potential growth, rewards, opportunity to flourish— they don't let these chances slip away. This concerns the way you perceive the world rather than the habit of toxic positivity. As discussed earlier, people with rich mindsets, take full responsibility for making sure that their dreams will turn into reality. "It will work because they'll make it work."

In the financial landscape, in almost all areas, the risk is synonymous to reward; wherein, the higher the risk, the higher the reward. The type of people who are willing to face great risks is those with rich mentalities. However, it is also noteworthy to point out that not everyone has this privilege. Not every one of us has the capacity to fail because it might be the only shot they have.

4. They do not parade their wealth.

Living a frugal lifestyle is their main goal. We are led to believe that the rich should wear fancy clothes, lush lifestyle, and have grand parties. Most true millionaires have a house they can afford and ensure to pay their debts and mortgages. Although they may buy a luxury car, but they make sure to use it for many years.

A wealthy man obtains success through their firm principle of integrity. They don't cheat their way up nor are dishonest scammers.

5. They regard saving and investing important.

One thing that all rich people have in common is they are committed to saving and investing, then making that money to work for them rather than the other way around. They are intentional in saving 10% or 20% of their monthly salary and make wise buying decisions. Paying their debts is the their priority so it won't hinder their financial plans.

To simply put, they devise strategies to make that happen, then follow it. Setting goals and focusing on them is a routine they strictly follow. Fortunately, at Gregory, we cultivate this mindset through planning your day for only 2 minutes in First Step Planner. Grab a copy to start working on the right mindset!