Living in the Philippines, navigating your finances can feel like traversing a bustling Divisoria market – vibrant, exciting, but sometimes overwhelming. Between balancing tight budgets, juggling debt, and figuring out how to save and invest, it's easy to feel lost in the financial maze.

But fear not, kababayan! We're here to equip you with practical "Pinoy Peso Power" hacks inspired by bestselling international finance books, helping you transform your financial journey into a confident, triumphant parade.

Budgeting Like a Pro

1. Embrace the "Sachet" System

Inspired by the Filipino love for pre-portioned goods, break down your budget into bite-sized "sachets" (weekly or bi-weekly) for essential expenses like food, transportation, and bills. This approach, as championed by Ramit Sethi in "I Will Teach You to Be Rich," helps avoid overspending and gives you a clearer picture of your cash flow, like meticulously organizing your favorite pasalubong.

2. Utilize Free Budgeting Apps

Technology can be your financial ally! Free and user-friendly apps like Gcash's GInvest and BPI's BPI Mobile, similar to the digital tools recommended by Barbara Huson in "The Complete Guide to Money & Investments," allow you to track your income and expenses, set spending limits, and receive alerts to stay on track. Remember, Filipinos' tech-savvy spirit can be harnessed to conquer financial goals.

3. Master the 50/30/20 Rule

This time-tested formula, popularized by Elizabeth Warren in "All Your Worth," can be your financial compass. Allocate 50% of your income to needs (food, rent), 30% to wants (leisure, dining), and 20% to savings and debt repayment. Adjust these percentages based on your unique situation, remembering Filipinos' adaptability and resourcefulness in adjusting to changing circumstances.

Conquering Debt

1. Avalanche vs. Snowball

Choose your debt-crushing strategy based on your personality. The Avalanche method, favored by Dave Ramsey in "Total Money Makeover," tackles high-interest debts first, like a determined warrior charging a hill, while the Snowball focuses on smaller ones for quicker wins and motivation, like celebrating each cleared "palengke" purchase.

2. Explore Debt Consolidation

If you're juggling multiple debts like a vendor at Divisoria, consider consolidating them into one loan with a lower interest rate. This, as recommended by Jean Chatzky in "The Debt-Free Blueprint," can simplify repayment and potentially save you money, making you feel like a financial mastermind.

3. Remember the Power of "Hustle"

Filipinos have a natural entrepreneurial spirit. Take on side gigs, freelance work, or small business ventures to boost your income and accelerate debt repayment. Remember, even a sari-sari store, as encouraged by Ramit Sethi in "I Will Teach You to Be Rich," can provide significant financial support.

Savings & Investment Savvy

1. Start Small, Dream Big

Filipinos have a cultural knack for "diskarte," making the most of limited resources. Even small, regular savings add up over time. Aim for 10-15% of your income, and gradually increase as your income grows, like a seed blossoming into a vibrant bougainvillea.

2. Utilize Pag-IBIG and SSS

Filipinos have access to unique social security and housing systems. Contribute to your Pag-IBIG and SSS accounts for retirement security and access to housing loans. Think of these resources as building blocks for your financial fortress, similar to the long-term investment strategies discussed by John Bogle in "Common Sense on Mutual Funds."

3. Explore Low-Risk Investment Options

Filipinos, with their risk-averse nature, may prefer low-risk investments. Mutual funds, UITFs, and government bonds offer opportunities to grow your savings with lower risk compared to stocks. Remember, consult a financial advisor before making any investment decisions, just like consulting an "albularyo" for important choices.

Bonus Tip: Invest in Yourself

The best investment you can make is in yourself! Filipinos have a strong emphasis on education and self-improvement. Upgrade your skills through online courses, workshops, or certifications to boost your earning potential.

Consider this an investment for your own– your unique talents and abilities, like honing a valuable skill for the "luho" of financial independence.

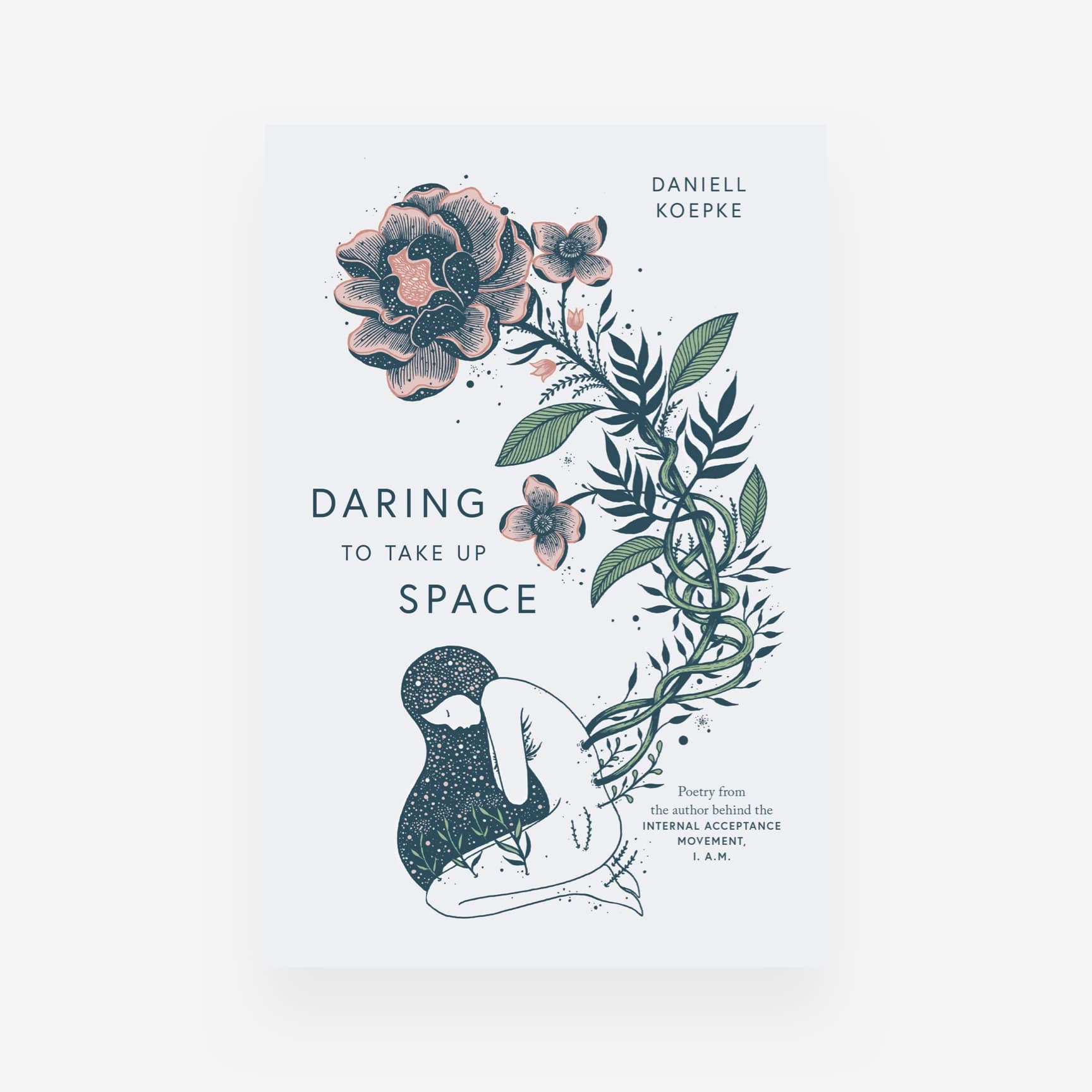

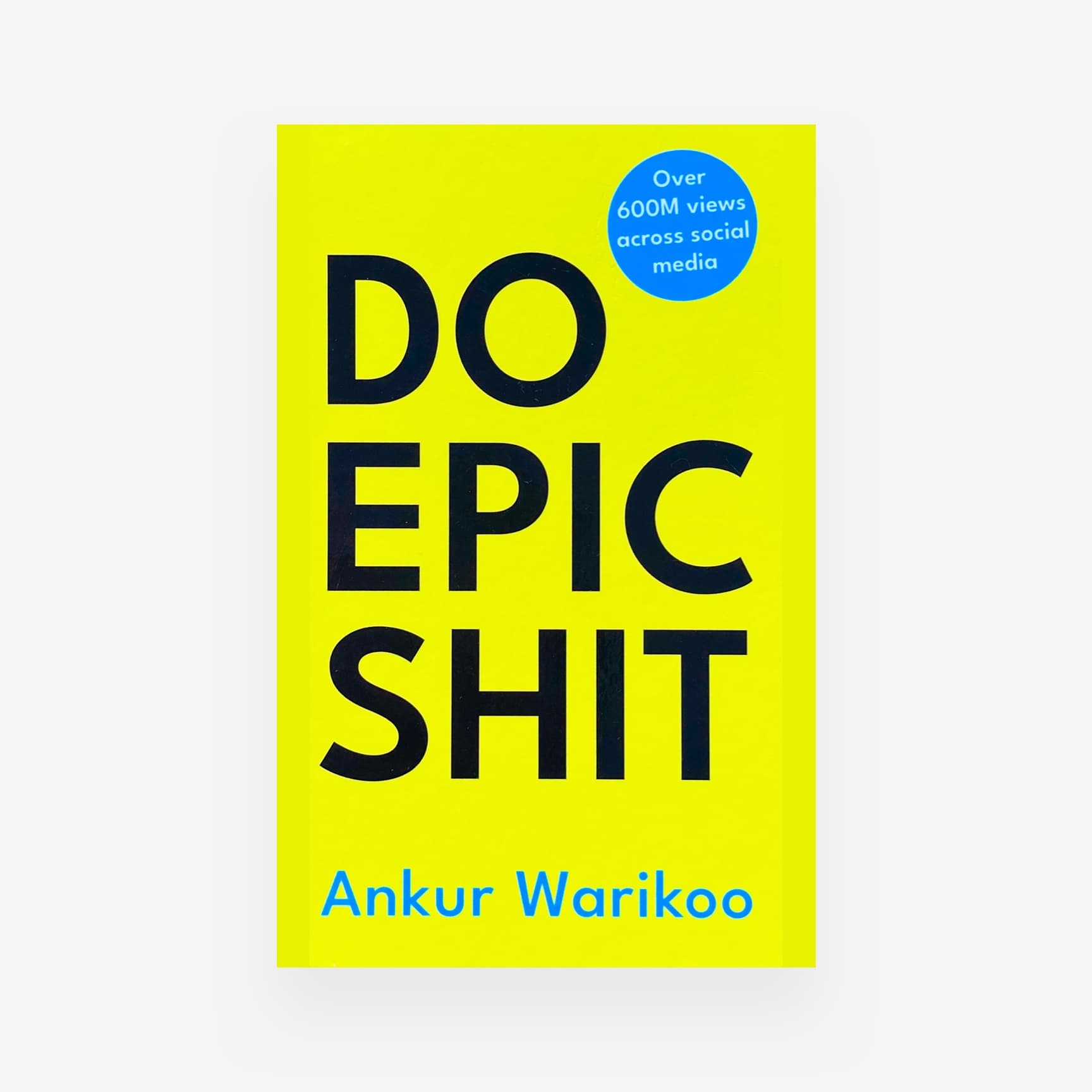

And for an extra dose of Pinoy Peso Power, check out these bestselling international finance books available at Gregory.ph: