Human nature appears to drive us to desire better things. The more money an individual earns, the more justifiable their spending becomes. If you drive a sedan right now, you will believe you deserve better, possibly even a luxury vehicle, sooner rather than later.

People become trapped in high-paying occupations that leave them with no time for themselves. And eventually, the individual feels trapped in a never-ending cycle of earning and spending more. Loans, expensive monthly loan payments, and personal obligations suffocate the person's life force. The person quickly finds himself in another conflict-related existential dilemma.

Those caught up in the rat race typically believe that money can fix life's problems. They forget that the genuine value of money is determined by how it adds to (or detracts from) their well-being, not by its numbers and amounts. Money can have unfathomable emotional, mental, and physical consequences for a person's mind, body, and soul.

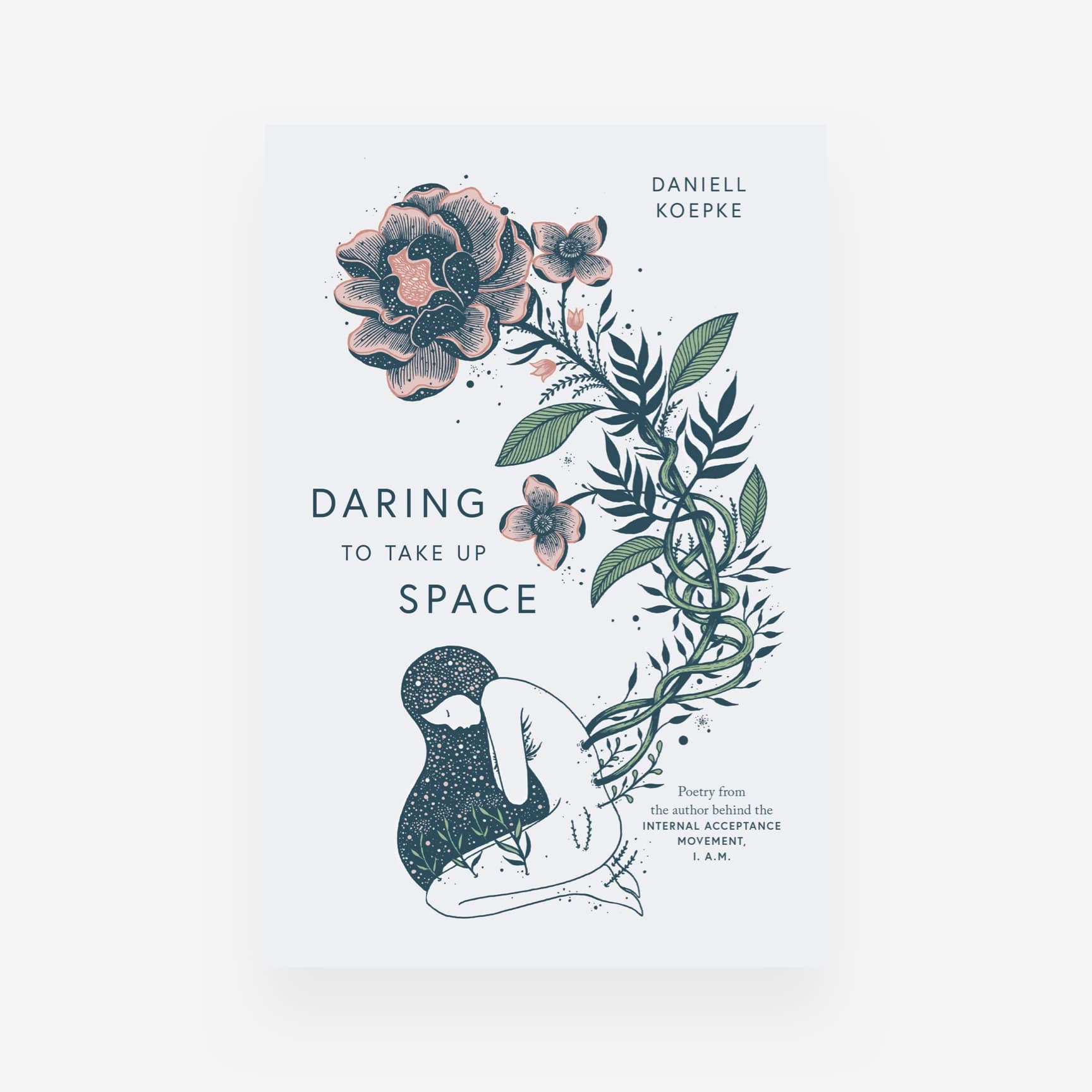

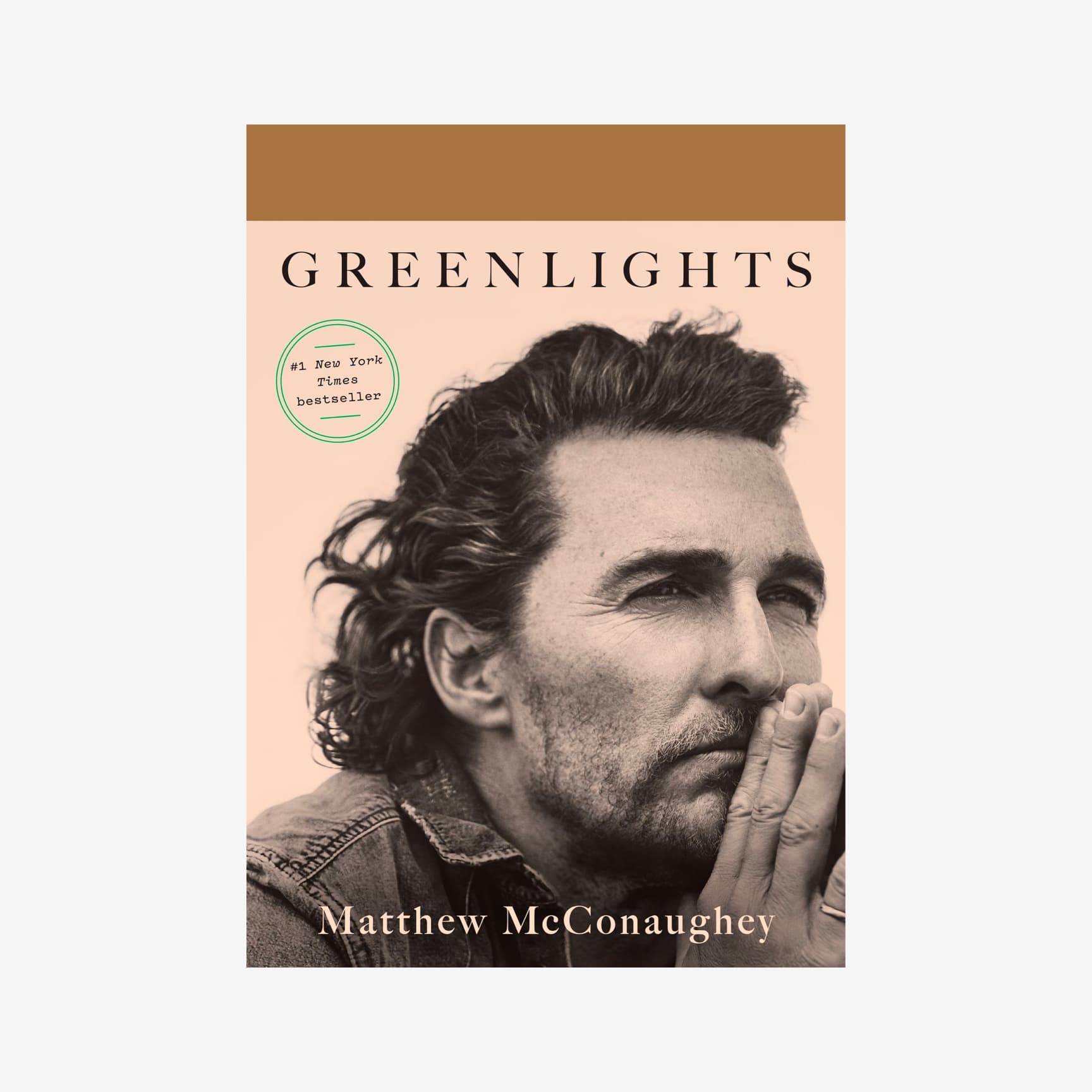

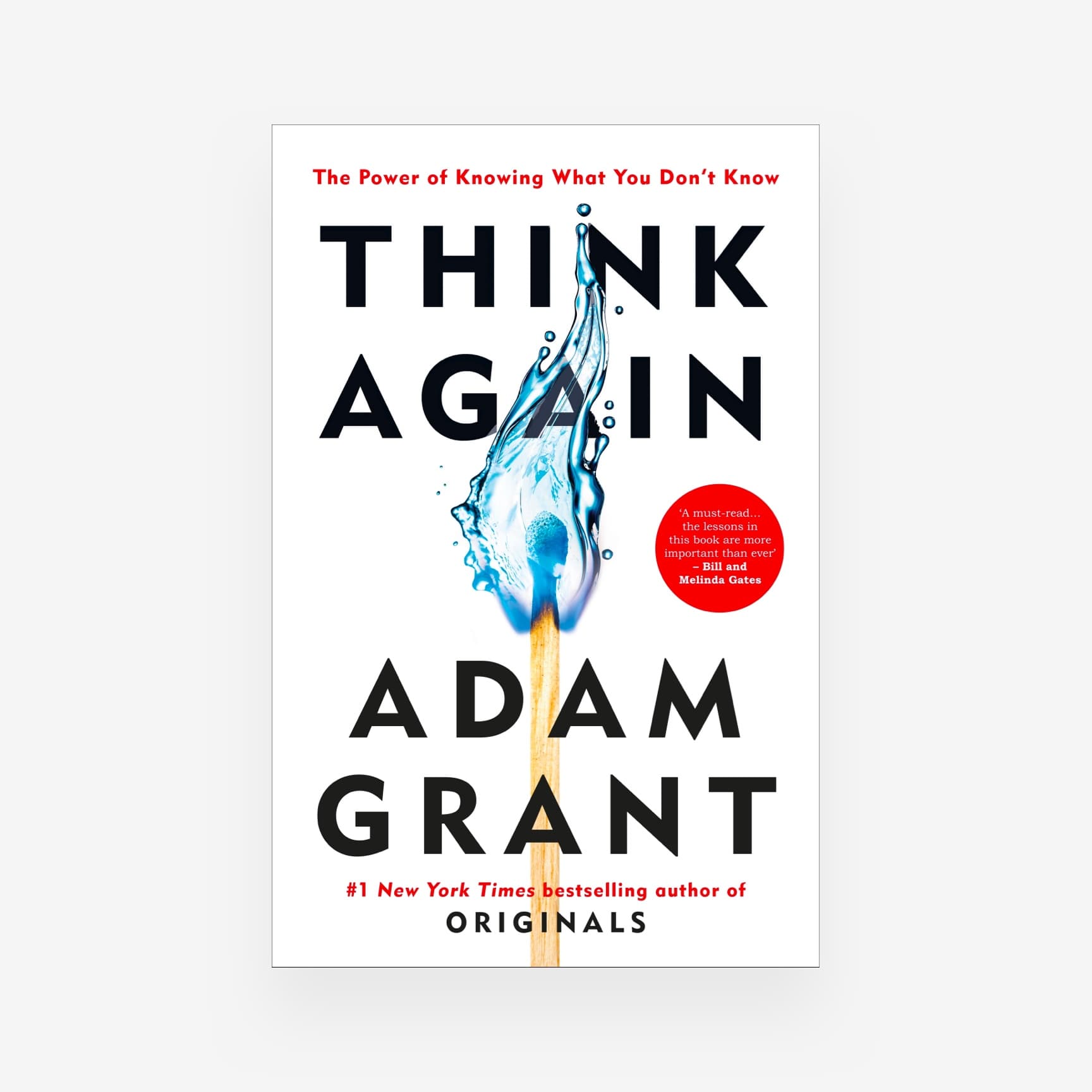

Photo grabbed from the wires

What is the Rat Race?

The phrase "rat race" first appeared in common parlance in the 1930s to indicate any strenuous and frequently competitive activity or habit. Particularly, a pressurized urban existence is spent trying to get ahead with so little time left for recreation, reflection, and so on.

The "rat race" essentially applied to anybody who felt trapped in a financial slog and dissatisfied without any time for their interests and hobbies. This behavior is especially prevalent among metropolitan professionals, whether blue-collar or white-collar.

To get you started, here is a broad path you might take to construct a strategy to break free of the rat race and regain control of your life.

Photo grabbed from the wires

1. Make a list of your objectives.

Escaping the rat race entails choosing the road less traveled, which can be frightening. To get out of the rat race, you must first understand why. It would be best if you articulated your reasons correctly to remain inspired to keep going when things get tough.

Writing out your value-based goals is a great way to define your life vision and cement your aspirations on paper. You can post your goals somewhere in your home as a regular reminder of the objectives you're aiming toward and why.

2. Keep track of your spending.

Following that, you must keep track of your spending for various reasons. Tracking your spending lets you understand your monthly expenses and how much revenue you'll need to create to leave the rat race.

People who want to get out of the rat race must usually think of ways to produce "passive" income. You do not always have to trade your time for money if you have passive income. Suppose you can devise a strategy for generating enough passive income to cover your monthly expenses. In that case, you'll be on your way to escaping the rat race.

3. Increase your earnings

If you cannot reduce your spending or if you wish to raise your income or generate numerous sources of revenue, you can increase your income or establish multiple sources of revenue.

There are numerous methods to raise your salary. Also, not all necessitate dropping everything and starting a business with a brand-spankin'-new idea that has never been dreamed of before.

Increasing your income may not be glamorous, but it can change your life. You may, for example, get a side hustle, such as driving for Uber or DoorDash, which lets you work for extra income whenever you want.

4. Invest your money

Unfortunately, there is no way to save your way to freedom from the rat race. Not only will you have to save enormous amounts of money, but the impact of inflation implies that cash in a savings account is actually losing value.

Investing your money is critical to breaking free from the rat race. When you invest your money, it has the chance to earn more interest than even an increased savings account.

5. Take small steps.

Unless you win the lottery or receive a large inheritance (which is unlikely), you are unlikely to quit the rat race in a single day, month, or even a year. It takes patience and tiny, continuous measures to get out of the rat race. On the other hand, small efforts can add up to actual financial freedom over time.

This is why it's critical to write down your goals so they're always at the forefront of your thoughts. It is not simple to get out of the rat race, but it is feasible. Every day, gently remind yourself of your why.