And how this book can help you, too.

Photo from the wires

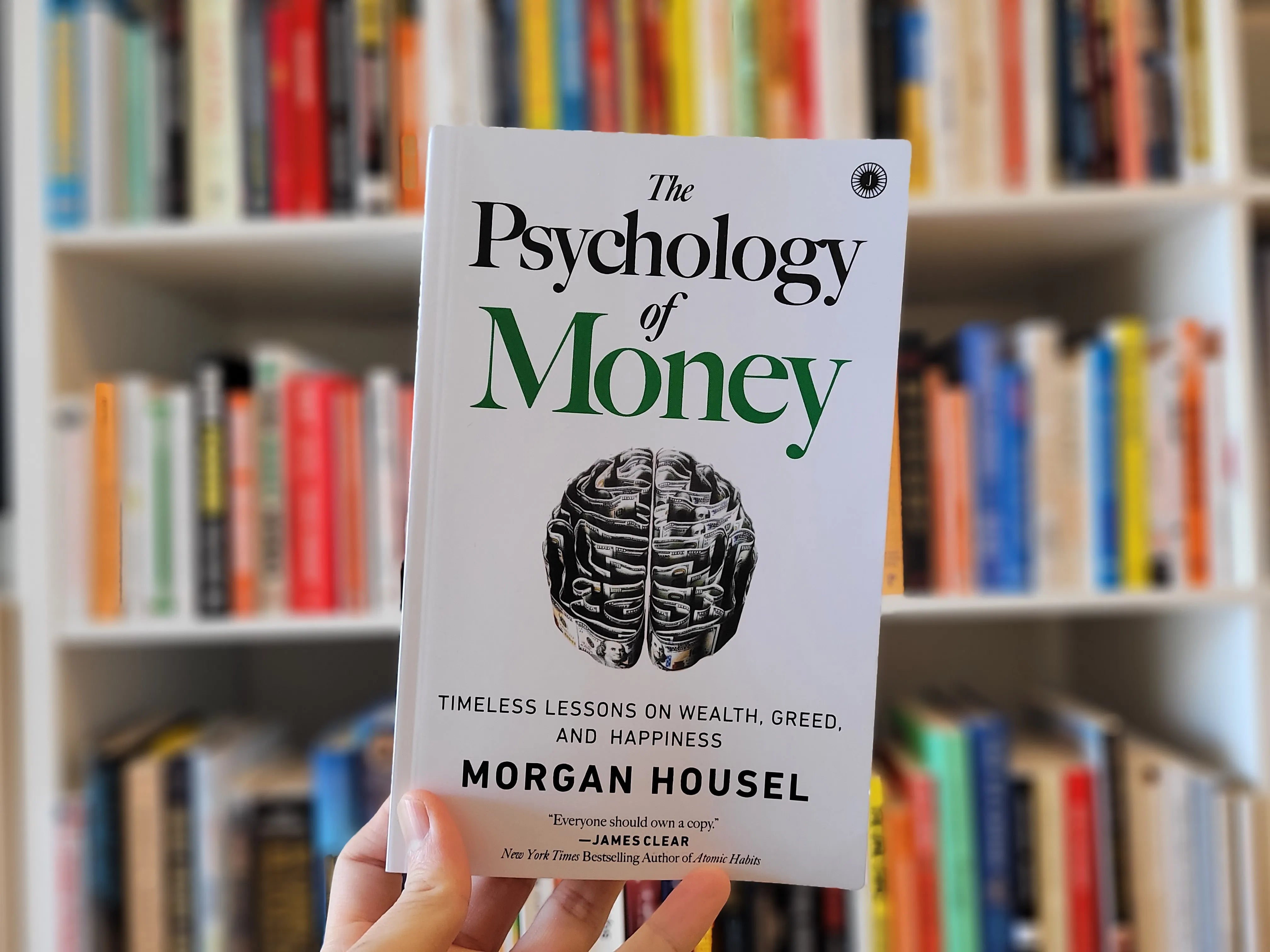

Morgan Housel's the Psychology of Money, teaches you how to improve your connection with money by making wise financial decisions. Rather than just pretending that humans are ROI-optimizing machines, he demonstrates how psychology can work both for and against you.

No wonder this non-fiction book is quite popular among professionals and in various online bookstores in the Philippines.

1. Theory isn’t reality

We are not calculators. As much as reading can teach us about what has happened in the past, such as market volatility or how stock markets have trended up and to the right over time, it is very different from actually experiencing the event.

So be cautious. You may believe that you can hold your stocks throughout a 30% market drop because you know that only suckers sell at the bottom, but you won't know what you'll do until you go through one.

2. Be reasonable with money

One of the book's most popular passages is when Housel says that being sensible with your money is more powerful than being rational.

He acknowledges that we are humans with emotions, which will inevitably influence how we feel and manage our money. Housel writes, "You're not a spreadsheet. You're a person. A screwed-up, emotional person. It took me a while to figure this out, but once it clicked I realized it's one of the most important parts of finance."

In other words, while anything might look great on paper solely based on the figures, that may not be the best long-term strategy.

3. Define what your 'enough' is

Many people believe that there is never enough money. Housel observes that the goalposts seem to shift all the time and that we constantly compare ourselves to others.

Housel shares narratives of greed and risk and how they would turn progress upturned and be the major setback of any success in the book, and he emphasizes the importance of determining what "enough" is for you when managing money and investing.

He writes, "If expectations rise with results, there is no logic in striving for more because you'll feel the same after putting in the extra effort. It gets dangerous when the taste of having more — more money, more power, more prestige — increases ambition faster than satisfaction."

4. Luck and Risk

In financial planning, it's easy to concentrate on our individual actions and overlook how our privilege — or, as Housel puts it, our luck and risk — can influence our financial results.

Housel tells a tale about Bill Gates. Gates attended high school with one of the first computers, which changed his life completely and career. Kent Evans, a school friend who was also talented with computers, was one of his friends. He was tragically killed in a mountaineering accident.

We can clearly see luck and risk in this example. They are the invisible puppet strings that can have an impact on our lives, careers, and finances.

5. Cash isn't the enemy

If you're young and earn more than you spend, investing the majority of your money in a diversified portfolio of low-cost index funds is the best way to maximize your long-term investment returns. And over a few points difference in your net worth should be held in cash because the value of cash declines with rising prices, and that cash can otherwise be invested in assets such as stocks, which have historically compounded at a rate of 6-7 percent.

Although it may seem appealing to invest in ways that will maximize your returns, these theories frequently fail to take your psychology into consideration. Depending on how you react to the crash, obtaining such a tiny fraction of funds may make a person more likely to panic and sell several of her stocks during the downturn. Furthermore, if you panic sells instead of holding a larger portion of your portfolio in cash and refrain from selling because you feel more secure, you may lose out on a lot more returns than you would have.